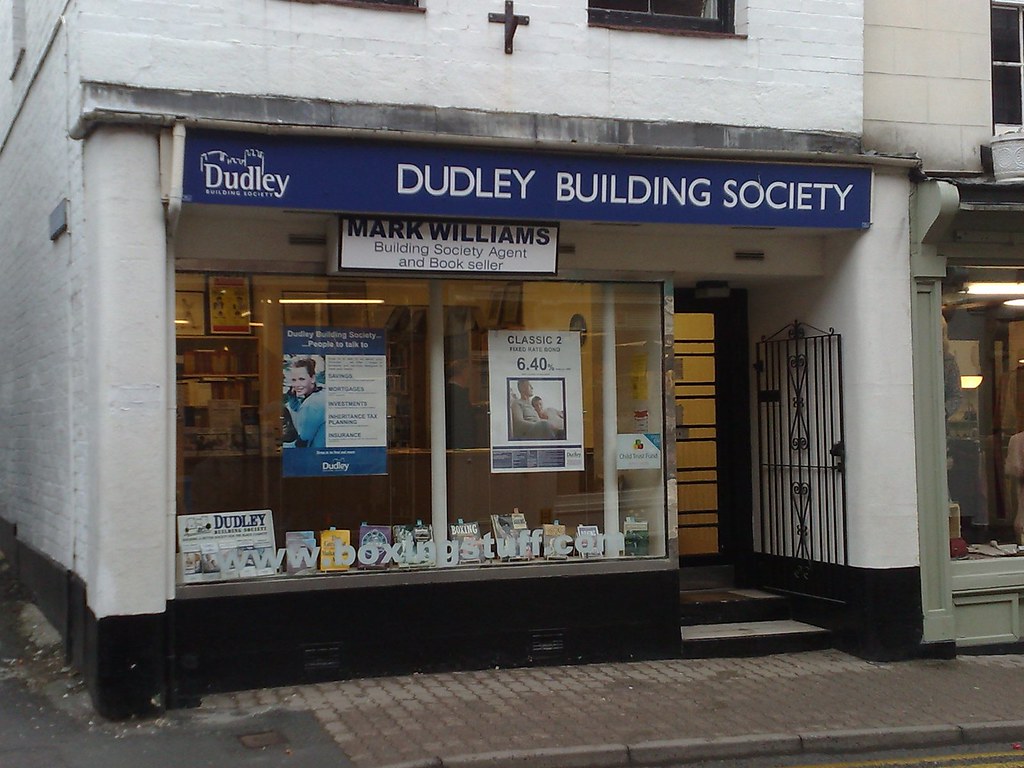

Homeownership is a dream for many people, but it can come with its fair share of challenges. From mortgage payments to property taxes, the responsibilities can seem overwhelming at times. However, what if there was a way to simplify your homeownership experience? A solution that makes it easier to manage your finances and enjoy the benefits of owning a home without the added stress. In this blog post, we’ll introduce you to Dudley Building Society Homeowner Loans and how they can help simplify your homeownership journey. So, whether you’re a first-time homeowner or looking to refinance your current mortgage, keep reading to learn more!

How to Qualify for a Dudley Building Society Homeowner Loan

To qualify for a Dudley Building Society Homeowner Loan, you must be a homeowner and have equity in your property. The amount of equity required will depend on the loan amount you are seeking. You must also be able to demonstrate that you can afford the monthly repayments, which will be assessed based on your income and expenses.

Additionally, the Dudley Building Society will conduct a credit check to ensure that you have a good credit history and are not currently in financial difficulty. If you meet these requirements, you may be eligible for a homeowner loan from Dudley Building Society.

It’s important to note that homeowner loans are secured against your property, which means that if you are unable to make the repayments, your home may be at risk of repossession. Therefore, it’s essential to carefully consider your financial situation before applying for a homeowner loan.

Benefits of Choosing Dudley Building Society for Your Homeowner Loan

Choosing Dudley Building Society for your homeowner loan has many benefits. Firstly, they offer competitive interest rates, making it easier for you to repay your loan. Secondly, they have flexible repayment terms that can be tailored to your specific needs and financial situation. This means that you can choose a repayment plan that suits your budget and lifestyle. Additionally, Dudley Building Society has a team of experienced professionals who are always ready to assist you with any questions or concerns you may have about your loan. They also offer a range of homeowner loan options, including secured and unsecured loans, so you can choose the one that best suits your needs. Finally, Dudley Building Society is committed to providing excellent customer service and ensuring that their clients are satisfied with their loan experience.

Different Types of Dudley Building Society Homeowner Loans Available

Different Types of Dudley Building Society Homeowner Loans Available

Dudley Building Society offers a variety of homeowner loans to suit different needs and financial situations. The most popular option is the Standard Variable Rate (SVR) loan, which allows borrowers to make unlimited overpayments without incurring any penalties.

For those who want more stability in their monthly payments, there are Fixed-Rate loans available with terms ranging from 2-10 years. This type of loan may be ideal for homeowners who prefer predictable payment amounts.

Another option is the Offset Mortgage Loan where you can offset your savings against your mortgage balance, reducing the amount of interest charged on your mortgage.

Additionally, they offer Discounted SVR Mortgages that allow borrowers a specific period at a discounted rate before reverting back to the standard variable rate.

Overall, Dudley Building Society provides flexible and affordable homeowner loans designed to simplify homeownership for everyone.

Frequently Asked Questions About Dudley Building Society Homeowner Loans

Dudley Building Society Homeowner Loans can be a great option for those needing to finance home improvements or other major expenses. Below are answers to some of the most frequently asked questions about these loans:

What is the maximum loan amount available?**

The maximum loan amount available through Dudley Building Society Homeowner Loans is £500,000.

How long does it take to get approved for a homeowner loan?**

Usually, approval for Dudley Building Society Homeowner Loans takes between 5 and 10 working days once all required documentation has been received.

What is the interest rate on Dudley Building Society Homeowner Loans?

Interest rates vary based on the type of loan and individual circumstances. It’s best to consult with a representative from Dudley Building Society directly for more information.

Can I use a homeowner loan for debt consolidation purposes?**

Yes, homeowners may choose to use their loan funds towards paying off high-interest debts such as credit cards or personal loans.

What fees should I expect when applying for a homeowner loan with Dudley Building Society?

There may be application fees, valuation fees, or legal fees associated with applying for and securing your homeowner loan. These will vary depending on individual cases.

In conclusion, Dudley Building Society offers a range of homeowner loans that can help simplify your homeownership journey. Whether you’re looking to make home improvements, consolidate debt, or simply need some extra cash, Dudley Building Society has a loan option that can meet your needs. With competitive rates and flexible repayment terms, their homeowner loans are designed to make borrowing easy and affordable. Plus, their friendly and knowledgeable staff are always on hand to answer any questions you may have and guide you through the application process. So why not consider a Dudley Building Society homeowner loan for your next big project or expense? It could be the key to unlocking the full potential of your home and achieving your homeownership goals.

Frequently Asked Questions

Who can apply for Dudley Building Society Homeowner Loans?

Homeowners in England and Wales who are 18 or older.

What are Dudley Building Society Homeowner Loans?

Loans secured against the borrower’s property for home improvements.

How much can I borrow with Dudley Building Society Homeowner Loans?

Between £10,000 and £500,000, depending on the borrower’s circumstances.

Who can I contact for more information about Dudley Building Society Homeowner Loans?

Contact Dudley Building Society directly or visit their website.

What happens if I can’t repay my Dudley Building Society Homeowner Loan?

The lender may repossess the property to recover the outstanding debt.

How long does it take to get approved for Dudley Building Society Homeowner Loans?

Approval times vary, but typically take a few days to a few weeks.